Unsecured consolidation loans offer UK residents a flexible debt management solution without requiring collateral. They combine multiple debts at potentially lower interest rates, simplifying repayment and saving money. With customizable terms, these loans cater to diverse budgets but come with higher rates than secured options. Secured loans provide lower rates but require collateral, balancing advantages for comprehensive debt relief through hybrid consolidation strategies. Responsible borrowing habits and creditworthiness are key to securing unsecured consolidation loans, which streamline payments for multiple debts.

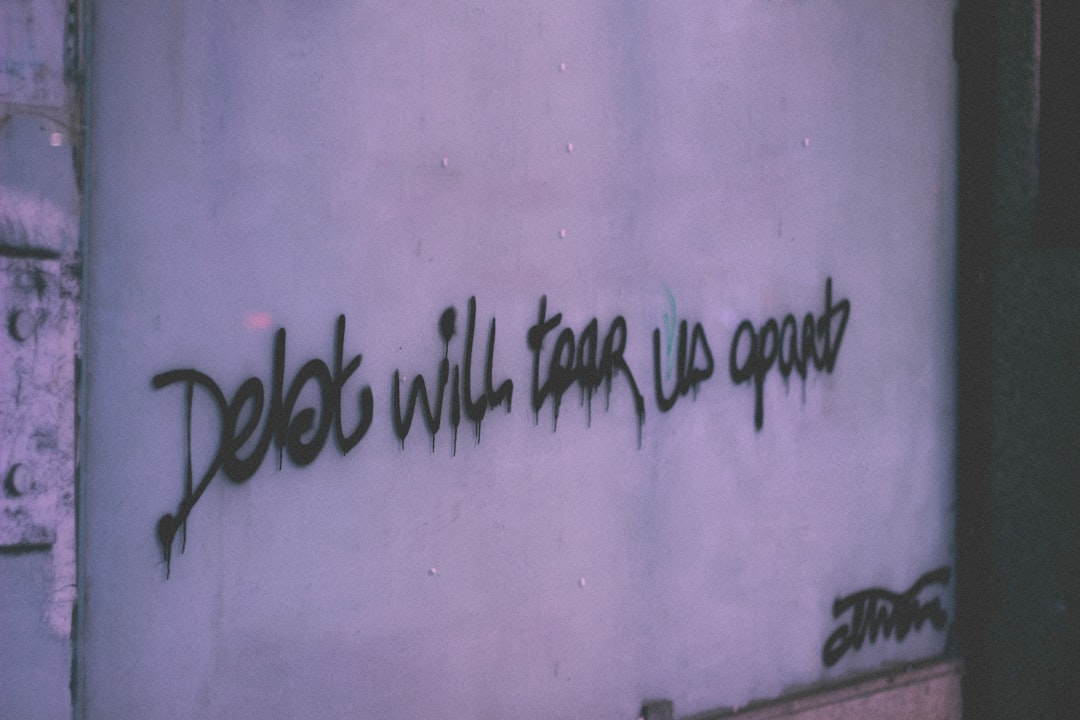

In today’s financial landscape, managing multiple debts can be a complex challenge. Debt consolidation loans offer a potential solution, with options ranging from secured to unsecured or a hybrid of both. This article delves into the intricacies of unsecured debt consolidation loans in the UK, exploring their benefits and drawbacks. We also examine secured loans as an alternative, discuss combining loan types, and guide readers on assessing creditworthiness and understanding repayment terms, empowering them to make informed decisions for financial freedom.

- Understanding Unsecured Debt Consolidation Loans

- Advantages of Choosing Unsecured Options

- Secured Loans: The Alternative Approach

- Combining Secured and Unsecured Loans

- Assessing Your Creditworthiness for Unsecured Loans

- Navigating Interest Rates and Repayment Plans

Understanding Unsecured Debt Consolidation Loans

Unsecured debt consolidation loans are a popular choice for UK residents looking to simplify their financial obligations. Unlike secured loans, which require borrowers to offer an asset as collateral, unsecured loans provide funding without any such security. This makes them accessible to a broader range of individuals, including those with less equity in their homes or other assets.

These loans work by combining multiple outstanding debts into a single repayment, often at a lower interest rate than the original debts. Borrowers then make payments on this new loan, which can significantly reduce monthly outgoings and simplify financial management. Unsecured consolidation loans are particularly attractive as they offer flexibility in terms of repayment periods, allowing borrowers to tailor their repayments to suit their budget.

Advantages of Choosing Unsecured Options

Unsecured consolidation loans offer several advantages, particularly for those seeking a flexible and hassle-free debt management solution. One of the key benefits is that these loans don’t require collateral, which means borrowers don’t have to put up any assets as security. This accessibility makes them an attractive option for many UK residents, especially first-time borrowers or those with limited asset options.

Furthermore, unsecured consolidation loans often come with lower interest rates compared to secured alternatives, as the lender assumes less risk. This can result in significant savings over the lifetime of the loan. With a variety of repayment terms available, borrowers can tailor their repayments to suit their income and budget, providing a sense of control and making it easier to stick to a debt management plan.

Secured Loans: The Alternative Approach

Secured loans offer an alternative approach to debt consolidation, providing a unique balance between traditional secured borrowing and unsecured options. Unlike unsecured consolidation loans, which rely solely on the borrower’s creditworthiness, secured loans require the provision of collateral, typically in the form of an asset such as property or a vehicle. This additional security can make them more accessible for individuals with less-than-perfect credit histories who might struggle to obtain unsecured debt relief options.

The advantage lies in potentially lower interest rates and more favorable terms, as lenders are willing to mitigate risk by securing the loan. However, borrowers must be mindful of the risks associated with using assets as collateral, including the potential loss of these valuables if they fail to make repayments. Secured loans can be a strategic choice for those seeking comprehensive debt management solutions, offering both advantages and drawbacks that should be carefully considered before committing.

Combining Secured and Unsecured Loans

Combining secured and unsecured loans can offer a flexible solution for debt consolidation. Secured loans, backed by an asset like property or a car, often provide lower interest rates and larger loan amounts. Unsecured loans, on the other hand, don’t require collateral but usually come with higher interest rates and smaller borrowing limits. By combining both types, individuals can tailor their repayment terms to their financial situation.

This hybrid approach allows for a balanced risk-reward scenario. Secured loans offer stability through fixed rates and potentially longer repayment periods, while unsecured options provide freedom from asset risk but may require stricter budgeting to manage higher costs. Such a combination can be ideal for those looking to simplify multiple debts into one manageable repayment stream while minimising potential financial strain.

Assessing Your Creditworthiness for Unsecured Loans

When considering unsecured consolidation loans, assessing your creditworthiness is a crucial step in ensuring a successful application. Lenders will evaluate your financial history and current debt obligations to determine if you are a suitable candidate for this type of loan. A strong credit score, demonstrated through a robust history of timely repayments on previous loans or credit cards, can significantly enhance your chances.

This assessment goes beyond just looking at your credit score. Lenders also consider factors like income stability and outstanding debt amounts. For unsecured consolidation loans, demonstrating the ability to consistently meet repayment obligations without relying on secured assets is essential. A responsible borrowing history and a solid financial plan are key to gaining approval for these loans, which can help simplify your finances by consolidating multiple debts into a single, more manageable payment.

Navigating Interest Rates and Repayment Plans

When considering debt consolidation loans in the UK, understanding interest rates and repayment plans is pivotal. It’s crucial to compare offers from various lenders as rates can vary significantly. Unsecured consolidation loans, for instance, often come with higher interest rates due to the lack of collateral, but they provide an opportunity to simplify repayment by combining multiple debts into one. Repayment terms typically range from 1 to 10 years, allowing borrowers to choose a plan that aligns with their financial comfort level.

Lenders may offer flexible repayment options, such as fixed monthly installments or interest-only periods, to make the process more manageable. It’s essential to read the fine print and ensure you can comfortably meet the repayment schedule to avoid additional fees or penalties. Understanding these aspects will help in selecting a debt consolidation loan that best suits your financial situation.

When considering debt consolidation loans in the UK, whether secured or unsecured, or a combination of both, it’s crucial to weigh the unique advantages and drawbacks of each option. Unsecured consolidation loans offer flexibility and lower risk, while secured loans can provide access to larger sums. Combining both types allows for customisation based on individual financial needs. Assessing your creditworthiness is key to securing favourable terms, and understanding interest rates and repayment plans ensures you make an informed decision that aligns with your UK financial landscape.