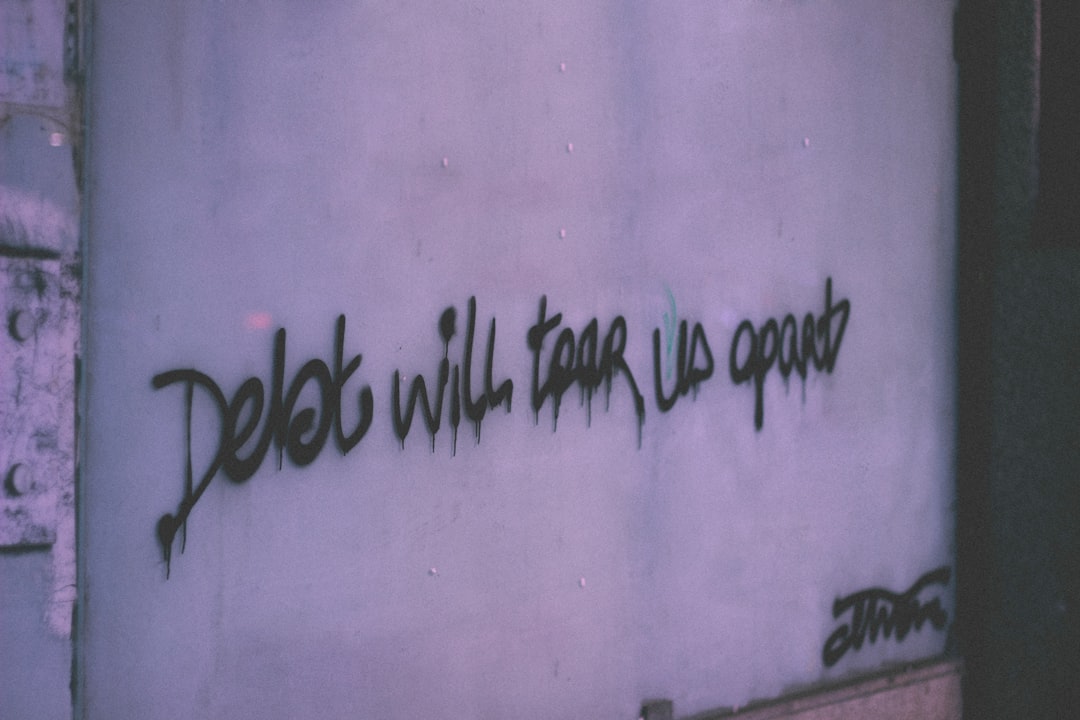

Married couples facing multiple debts can find relief with Unsecured Consolidation Loans. These loans simplify budgeting by combining various debts into one fixed-rate payment, lowering administrative burdens and potentially saving money on interest. By consolidating, couples free up cash flow, focus on repayment, improve credit scores, and achieve long-term financial stability. Key steps include assessing the financial situation, setting goals, maintaining timely payments, and creating a budget to prioritize high-interest debts. With strategic planning, unsecured consolidation loans help couples conquer debt, strengthen their bond, and secure a brighter financial future.

“Married couples facing financial challenges often seek solutions to simplify their debt burden. Enter joint debt consolidation loans, a strategic move towards financial stability. This article explores unsecured consolidation loans as a viable option for couples with one primary income source. We’ll delve into the benefits, from reduced interest rates to streamlined repayment processes. Learn how these loans can transform your financial landscape, offering a clear path to pay off debts and secure a brighter future together.”

- Understanding Joint Debt Consolidation Loans

- Advantages for Married Couples with One Income

- How Unsecured Consolidation Loans Work

- Steps to Secure a Joint Loan as a Couple

- Tips for Effective Repayment and Savings

- Real-Life Success Stories: Joint Debt Consolidation

Understanding Joint Debt Consolidation Loans

In today’s financial landscape, many married couples face the challenge of managing multiple debts with a single income. This is where unsecured consolidation loans step in as a strategic solution. These loans allow couples to combine their various debt obligations into a single, more manageable payment, streamlining their financial responsibilities. By consolidating, partners can reduce the stress and complexity associated with multiple payments due each month.

Joint debt consolidation loans offer a simplified approach by providing a single loan with a fixed interest rate and a set repayment term. This method not only eases the administrative burden of tracking multiple debts but also potentially lowers overall interest expenses. With an unsecured consolidation loan, married couples can focus on rebuilding their financial stability and achieving long-term monetary goals.

Advantages for Married Couples with One Income

For married couples where one partner earns an income, joint debt consolidation loans offer several advantages. Unsecured consolidation loans allow both partners to combine their debts into a single, more manageable payment. This simplification reduces stress and makes budgeting easier by eliminating multiple due dates and varying interest rates. With these loans, the couple can focus on paying off the loan rather than juggling various debt obligations.

Additionally, joint consolidation loans often provide lower interest rates compared to individual loans, saving money in the long run. This is particularly beneficial for couples with high-interest debts like credit card balances. By consolidating, they can free up extra cash flow each month that was previously spent on interest payments, enabling them to allocate more resources towards paying off the loan and achieving financial stability.

How Unsecured Consolidation Loans Work

Unsecured consolidation loans offer a straightforward approach to debt management for married couples facing multiple debts with varying interest rates. This type of loan allows borrowers to combine all their eligible debts into one new loan, simplifying repayment and potentially saving money on interest charges. The process involves applying for a single loan that pays off the existing debts, providing relief from multiple monthly payments.

These loans are ‘unsecured,’ meaning they’re not backed by collateral like a home or car. Instead, lenders assess the couple’s creditworthiness based on their joint income, credit history, and debt-to-income ratio. This makes them accessible to many married couples, even those with less than perfect credit. Effective management of these loans requires disciplined repayment to avoid additional fees and maintain a positive financial outlook for the future.

Steps to Secure a Joint Loan as a Couple

When considering an unsecured consolidation loan as a married couple with one income, there are several key steps to ensure a smooth process. Firstly, assess your financial situation together and determine your budget. This involves evaluating all your existing debts, monthly expenses, and any savings you might have. Once you understand your financial landscape, discuss your goals for debt consolidation—whether it’s simplifying payments or reducing interest rates.

Next, improve your credit score as a couple. Lenders often consider both spouses’ credit histories when approving joint loans. You can enhance your collective creditworthiness by paying bills on time, keeping credit card balances low, and regularly checking your credit reports for errors. With a stronger credit profile, you’ll be more likely to secure favorable loan terms.

Tips for Effective Repayment and Savings

When considering unsecured consolidation loans for married couples with a single income, efficient repayment and savings strategies are key to financial success. Firstly, create a detailed budget that allocates fixed expenses, variable costs, and loan repayments. This ensures every dollar is accounted for, allowing you to identify areas where adjustments can be made to free up funds for additional debt reduction or savings.

Prioritizing high-interest debts within your consolidation plan is another effective strategy. By focusing on paying off these debts faster, you’ll reduce the overall interest paid over time, saving money in the long run. Additionally, consider setting up automatic payments to avoid late fees and maintain consistent progress towards debt elimination. Regularly reviewing and adjusting your budget will empower you to stay on track, make informed financial decisions, and achieve meaningful savings alongside your consolidation loan repayments.

Real-Life Success Stories: Joint Debt Consolidation

Many married couples have found success in managing their finances through unsecured consolidation loans. These stories often begin with a mountain of debt, accumulated over time from various sources like credit cards, personal loans, and even previous mortgages. By pooling their debts into one comprehensive loan, they gain clarity and control.

In these real-life scenarios, couples work together to create a budget and repayment plan tailored to their income. With the burden of multiple payments replaced by a single, manageable loan, they free up valuable funds for other aspects of their lives. This strategy not only alleviates financial stress but also strengthens their bond as they navigate this journey towards debt-free living, often with savings to spare.

For married couples facing financial challenges with one primary income, unsecured consolidation loans offer a viable solution. By pooling their debts and combining them into a single loan with potentially lower interest rates, they can streamline repayments and reduce the burden of multiple payments. This strategic approach not only simplifies budgeting but also paves the way for better financial stability and long-term savings, making unsecured consolidation loans a powerful tool for managing joint debt effectively.